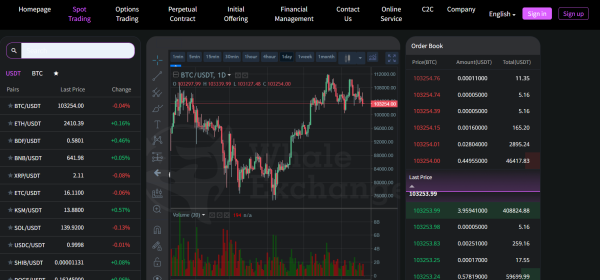

Whale Exchange Reinvents the Crypto Trading Landscape with Artificial Intelligence at the Core of Financial Autonomy

In an industry often characterized by incremental change and hype cycles, true paradigm shifts are rare. Yet, quietly and deliberately, Whale Exchange is orchestrating one. The digital asset platform, until recently a relatively modest player in the hyper-competitive crypto trading landscape, is now positioning itself at the forefront of one of the most ambitious overhauls in financial technology: building the first fully AI-native crypto exchange.

Where other exchanges have treated artificial intelligence as a feature—useful but not essential—Whale Exchange is betting its future on AI being the fabric of every financial decision. Not merely an overlay for faster order books or smarter bots, but a complete reengineering of how a trading ecosystem should function in an era where machine intelligence is fast eclipsing human cognition in both speed and scope.

From Tool to Architect: Reimagining AI’s Role in Financial Systems

For decades, financial institutions have sought to incorporate automation and data modeling into their strategies. Yet the dominant paradigm has always been human-first—AI has been a subordinate, a tool to support human judgment.

Whale Exchange aims to flip this paradigm.

In an exclusive interview, Whale Exchange’s Head of R&D elaborated on the bold pivot:

“The traditional model is like adding an autopilot to a car—helpful, but still reliant on human oversight. We’re building something closer to an autonomous vehicle, where AI is not the assistant but the driver.”

This reframing changes everything—from exchange architecture and liquidity models to governance and compliance. According to internal documents, the company is redesigning its infrastructure to support:

Autonomous liquidity provisioning

Self-training risk engines

Sentiment-informed pricing mechanisms

AI-governed market compliance filters

Federated AI collaboration among verified nodes

The implications are vast. If successful, Whale Exchange could become the blueprint for the next generation of digital finance—one where decentralized intelligence, not just decentralized assets, underpins market activity.

Building in Layers: An AI Stack for Trading Autonomy

At the heart of Whale Exchange’s transformation is a multi-layered AI architecture built to ingest, process, learn from, and respond to a variety of financial data streams in real time. The system comprises four key strata:

Sensory Layer (Data Ingestion): Pulling from on-chain activity, macroeconomic feeds, social sentiment, and user behavioral patterns.

Interpretive Layer (Semantic Understanding): Using natural language models and multi-modal transformers to identify correlations and anomalies in both structured and unstructured data.

Decision Layer (Predictive Modeling): Neural networks trained on proprietary historical and real-time market data to simulate market outcomes and recommend optimal actions.

Execution Layer (Autonomous Action): Smart contracts and adaptive bots that can execute strategies autonomously within defined parameters, adjusting in real-time to volatility or structural shifts.

This vertically integrated AI stack is intended to replace the traditional tiered exchange model—where each function (risk, trading, settlement) is siloed and often redundant.

The Philosophy Behind the Platform: Intelligence as Infrastructure

Unlike many in the space who treat AI as an optimization tool, Whale Exchange’s leadership sees machine intelligence as a fundamental infrastructure layer—on par with blockchains, databases, and cloud servers.

This philosophical stance informs the exchange’s governance model as well. The team is developing a protocol for Decentralized AI Governance—a set of programmable, auditable rules that define how AI agents interact with users and the exchange itself. This includes:

Open AI audit logs

Community-driven model validation

User-defined AI permissions

Fail-safes against algorithmic exploitation

Such transparency is key in a world increasingly concerned with AI opacity and unchecked automation. “We cannot hand over the financial future to black-box algorithms,” noted Whale Exchange’s compliance chief. “Our approach is to build ‘glass-box AI’—intelligent, but explainable and controllable.”

A Global Sandbox for AI-First Finance

To realize its ambitious blueprint, Whale Exchange is not working alone. The company has launched a multi-year Global AI Collaboration Program, a hybrid of research consortium and talent accelerator.

The program seeks to bring together:

AI researchers from top universities

Startups in predictive modeling and autonomous systems

Ethics scholars focusing on algorithmic accountability

Veteran quant developers and financial engineers

Participants will have access to Whale Exchange’s proprietary datasets—spanning market tick data, user interactions, and transaction patterns—and tools to build experimental models within a sandboxed environment. In return, Whale offers grants, tokenized incentives, and co-authorship in joint publications.

“We’re not just building a platform,” said a program manager. “We’re curating a new scientific community—one that treats finance as a living, learnable system.”

Partnerships and the Rise of Academic-Fintech Hybrids

As part of this initiative, Whale Exchange is formalizing partnerships with institutions in Singapore, Zurich, Toronto, and Tokyo. These collaborations will support joint labs focused on areas such as:

Responsible AI in trading

Human-AI collaboration protocols

Federated learning for cross-border compliance

On-chain explainability models

This model of hybrid R&D—part academic, part commercial—mirrors successful approaches in biotech and aerospace. It allows Whale Exchange to incubate ideas beyond the pressure of product roadmaps while maintaining a clear line of sight to market deployment.

Democratizing the Tools of the Elite

While the underlying infrastructure is advanced, the ultimate goal of Whale Exchange is accessibility. A major aspect of the roadmap is a suite of tools designed for retail investors:

AI Portfolio Assistants: Personalized agents that help users build and rebalance portfolios based on macro data, personal goals, and behavioral insights.

Sentiment Trading Modules: Interfaces that allow non-programmers to visualize and respond to market sentiment data extracted from Reddit, X (formerly Twitter), and Telegram groups.

Educational Co-Pilots: AI guides that walk users through market mechanics, from liquidity depth to options strategies, in real-time and in plain language.

In doing so, Whale Exchange is challenging the long-standing divide between institutional and retail capabilities. As one investor noted: “What Bloomberg terminals did for traders in the 1990s, Whale’s AI agents may do for the average crypto user in the 2020s.”

Regulatory Readiness in the Age of AI Finance

With such radical innovation comes scrutiny. Whale Exchange is proactively engaging with regulators in major jurisdictions, from the Monetary Authority of Singapore (MAS) to the European Securities and Markets Authority (ESMA), to ensure that its AI frameworks meet emerging compliance standards.

In particular, Whale is pioneering:

Audit Trails for Machine Decisions: Log-based architecture that can retrospectively explain and validate AI actions.

Risk Flagging via AI Self-Monitoring: Models that report their own confidence scores and request human intervention when thresholds are breached.

User-Centric Data Policies: Opt-in governance mechanisms for data contribution and model training.

By embedding compliance at the model level, Whale Exchange hopes to lead not only in innovation but in setting the standard for safe AI deployment in financial contexts.

Conclusion: The Exchange as an Evolving Intelligence

If successful, Whale Exchange’s AI-native design may change the very notion of what an exchange is. Rather than a static venue for trades, it becomes a dynamic intelligence—one that learns, adapts, and evolves alongside its users and markets.

In the coming years, Whale’s trajectory will serve as a litmus test for a broader question: Can artificial intelligence not only augment finance but reinvent it? With boldness, transparency, and a willingness to rethink every assumption, Whale Exchange may just offer the first real answer.

Media Contact

Organization: Whale Exchange

Contact Person: Raymond Tom

Website: https://www.whalebitx.com

Email: Send Email

Country:United States

Release id:29608

The post Whale Exchange Reinvents the Crypto Trading Landscape with Artificial Intelligence at the Core of Financial Autonomy appeared first on King Newswire. This content is provided by a third-party source.. King Newswire makes no warranties or representations in connection with it. King Newswire is a press release distribution agency and does not endorse or verify the claims made in this release. If you have any complaints or copyright concerns related to this article, please contact the company listed in the ‘Media Contact’ section

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Article Gaze journalist was involved in the writing and production of this article.